At least once a month, every month, after Ken B. and his fiancée's grace period ends, the couple will write regular checks to loan collection agencies for $3,500.

"It is disturbing that some of my loans have interest rates that vary from 9 to 15 percent ... but when students are faced with either private loans or dropping out due to costs, what else can you do?" said Ken, a 2006 graduate of the Kogod School of Business and School of Public Affairs who requested his full last name be omitted for this article. "You have to take the loan to continue your education. Now, my fiancée and I [both AU graduates] are facing close to $386,000 outstanding."

But Ken, who said he blames his current financial situation on a lack of debt education and financial aid help, may soon find himself in significant company.

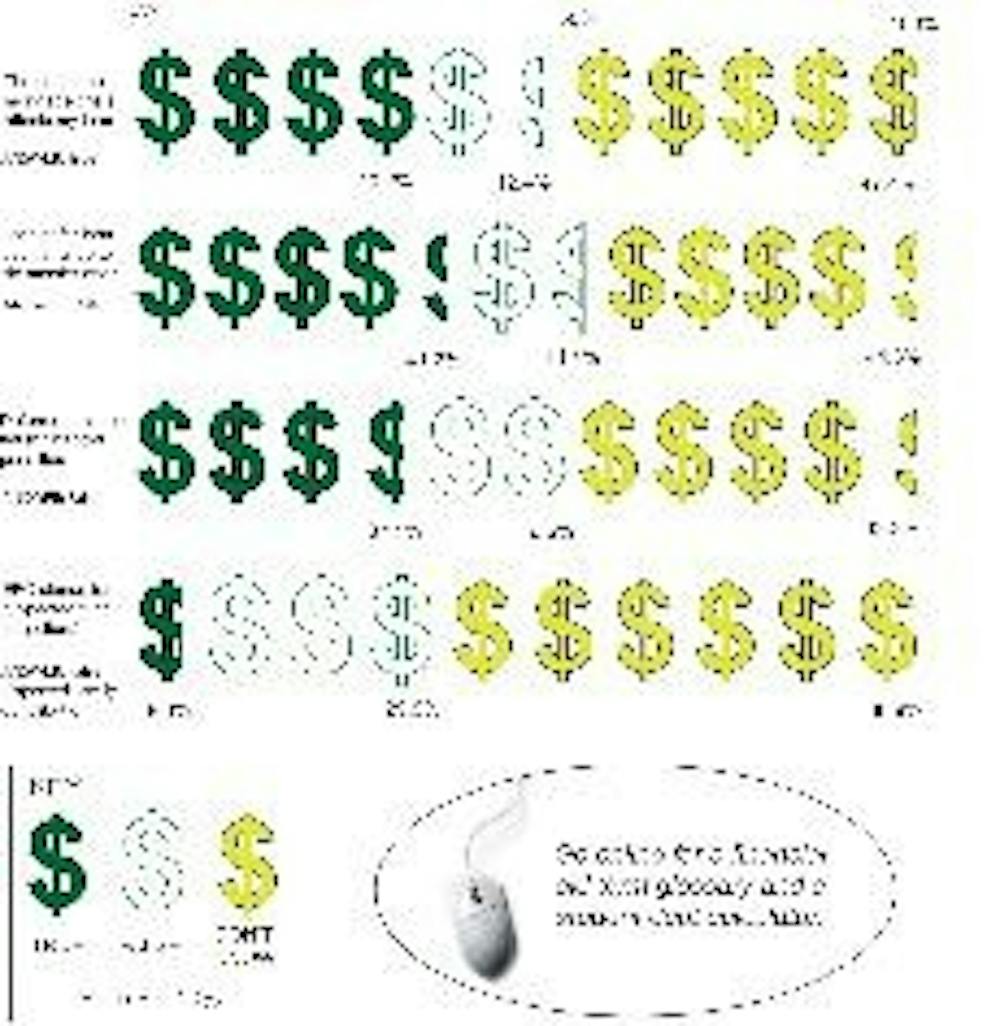

In an unscientific investigation of student financial literacy at AU, half of all respondents indicated the university's Office of Financial Aid failed to educate them about debt. Additionally, 46 percent of those surveyed said they felt the office's staff did not care about their financial well-being.

Throughout the four-week investigation, 107 current undergraduate students of varying class standings completed a 23-question survey, which was available on the Internet and in paper form. More than two-thirds of the students who responded indicated they received institutional financial aid. Half of all respondents paid for their education using outside student loans.

"I believe that there may be larger issues at play that may better clarify your findings," said Shirleyne McDonald, AU's associate financial aid director. "You may be surprised to know that only about 50 percent of AU students apply for financial aid. Thus students who have not applied for financial aid may not pay any attention to the information that has been provided by our office."

However, 13 percent of respondents who received institutional financial aid this academic year labeled their financial aid counselors as "good financial help resources." And more than half of those same students found the office wholly inaccessible.

Haig Kherlopian, a senior in SPA, said he had a good experience with his old financial aid counselor.

"But it's been different since she left," Kherlopian said. "Students don't know their own counselors, and that's a major problem."

Indisputably illiterate

Even Student Government President Joe Vidulich struggled to complete the survey.

"Nope, no idea," Vidulich said as he stared at a question about the effects of the sub prime mortgages on student loans. "I hope my grandparents leave me something in their will; I have no idea what forbearance or cancellation or discharge means."

Of course, Vidulich isn't alone; most respondents, when asked to indicate whether nine provided statements were true or false, either chose incorrectly or indicated they did not know the answer.

Almost three-quarters of student respondents who paid for school using student loans believed or did not know whether deferments would result in harsh financial penalties. In fact, almost all student loans come equipped with a six-month deferment period, according to the Office of Financial Aid.

Additionally, 60 percent of surveyed students who receive institutional financial aid indicated they were unfamiliar with the acronym "EFC" - "expected family contribution." The EFC is the primary number colleges use to determine students' financial aid packages, according to the Department of Education's Web site.

"I don't know any of these terms," said Mike Lally, a freshman in SIS. "I am absolutely clueless; all I know is that it's going to take a long time to pay off my debt."

Brian Lee Sang, AU's financial aid director, said the most accurate explanation for students' financial illiteracy was their 'wait and see' mentality.

"When you're talking about whether students are educated about financial aid processes ... I think what you find is that most students are dependent and they rely on their parents to follow through with it," Lee Sang said. "But most students don't get involved until something goes wrong; repayment doesn't occur until six months after graduation, so they are oblivious to it."

As a result of this time frame, students often disregard debt education completely, Sang said.

Although federal law requires students to complete entrance counseling before they receive federal loans, students often breeze through the required test, he said. As a result, most graduates are surprised to learn their promissory note says something different than they first imagined.

But no matter how grave the consequences of such oversights, students rarely repeat these mistakes, Lee Sang said, later adding that it is not the office's policy to allow students to falter.

That kind of passive mindset is immensely irresponsible, said Alan Collinge, the founder of Student Loan Justice, a political action committee that focuses on student debt rights.

According to Collinge, the less financial aid offices educate students about debt, the more likely students are to solicit unfriendly loans and make bad financial decisions. Since one out of every 10 college students is likely to default on their debt within 10 years of graduation - although AU's default rate is 1.4 percent, almost half of survey respondents did not know what a default was - the mistakes people make as young adults become lifelong hardships, he said.

"The first thing on students' mind is getting registered for class," Collinge said. "They jump through hoops and take the path of least resistance to do it. But at the end of the day, if things go wrong, students pay the price. There is no escaping this debt, and it's reached truly crisis proportions."

Emphasizing the right kind of education

Reflecting on his time as an undergraduate student, Sang said excessive financial education often has the opposite effect on students.

"Students are worried about doing the college thing - and rightfully so - and they don't want to read a financial aid document," he said. "If students see [financial aid education] as an administrative obstacle, it'll become more of a negative in their minds."

Even so, the office tries to take an active role in students' financial decisions, McDonald said.

This year alone, the Office of Financial Aid distributed flyers about important deadlines, offered counseling sessions for students and parents confused by the Free Application for Federal Student Aid, worked with Women's Initiative to present an event about credit and repayment and distributed a biannual newsletter, she said.

In addition, the university offers special sessions during Freshman Day and summer orientations to teach students about financial aid, according to Nathan Price, special assistant to the provost.

But most of this information is ineffective and never reaches students, Vidulich said.

"A stupid little infantile crossword puzzle is no way to talk to students about financial aid," he said. "Putting out passive newsletters or advertisements on Today@AU is not discussing financial aid."

The financial aid seminar is not mandatory during Freshman Day, which is a problem because most students make their financial decisions long before the more formal orientation in the summer, Vidulich said.

"If you don't have good financial planning early on, you're never going to have it," said Liz Bayer, a freshman in SIS. "I feel like more information and guidance would be nice"

It's "no worse here"

Ken, who is currently postponing the costs of financial illiteracy because of a generous forbearance, said the true problem is clear in his mind - bureaucracy has undermined whatever financial help resources AU had to offer.

"At no point did the financial aid office ever help me ... or educate me about loans or debt; any knowledge on loans I had to learn on my own," Ken said. "Student Accounts and the Registrar were impossible to deal with."

Price said the university has made great strides to decrease bureaucracy. In the past few years, administrators from the Registrar, Student Accounts and Financial Aid offices, among other university organs, have collaborated extensively to defeat inefficiency, he said.

The foremost committee that steered these adjustments is the Customer Experience Initiative Team, which the university organized in 2005 specifically to tackle the "Bermuda triangle" problem, Price said. After a 2005 report submitted in part by his office identified key troubles in the financial aid bureaucracy, AU administrators began to cross-train university staff through CEIT, he added.

According to Mark Welch, director of Student Accounts, CEIT training has done wonders for AU's financial aid system.

"What we've really accomplished is getting to know each other," Welch said. "When you're located in different buildings, you don't always know what's going on."

The CEIT process also paved the way for a new office phone system, in which students could call the office and speak directly with a financial aid counselor instead of a machine or student representative, Lee Sang said. And soon, CEIT and an independent consultant hope to launch the newly streamlined university Web site, he said.

Still, true reform isn't exactly on the horizon, Vidulich said.

"What we really need is a one-stop shop," he said. "There's no reason why students need three offices ... just to get the money they're entitled to or receive unbiased advice."

Despite space considerations, the university has researched the possibility of a central financial aid hub, Price said. CEIT first proposed the creation of a "satellite one-stop shop" staffed by highly cross-trained Financial Aid, Registrar and Student Accounts employees. However, each university organ would retain its current, separate location, Price said.

But to Welch, any large-scale overhaul would be largely unnecessary.

"From my perspective from working at several other schools, financial aid offices face the same obstacles everywhere," Welch said. "The 'Bermuda Triangle' is no worse here than at any other school"